27th

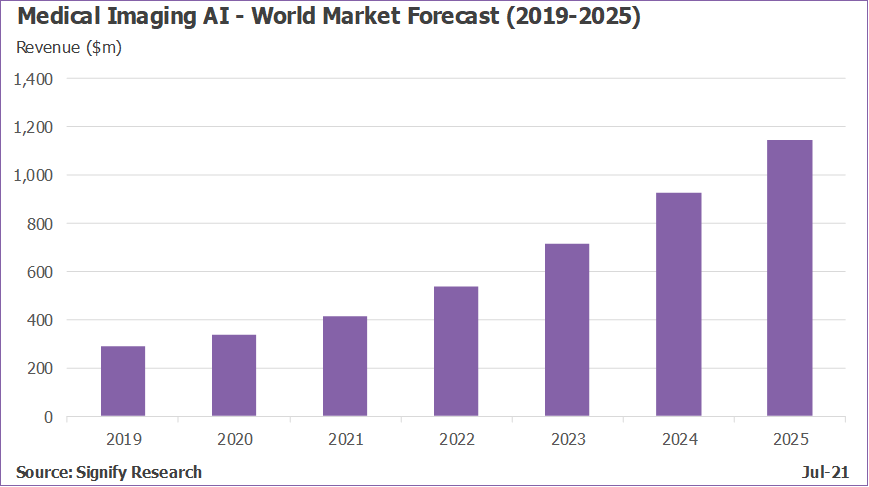

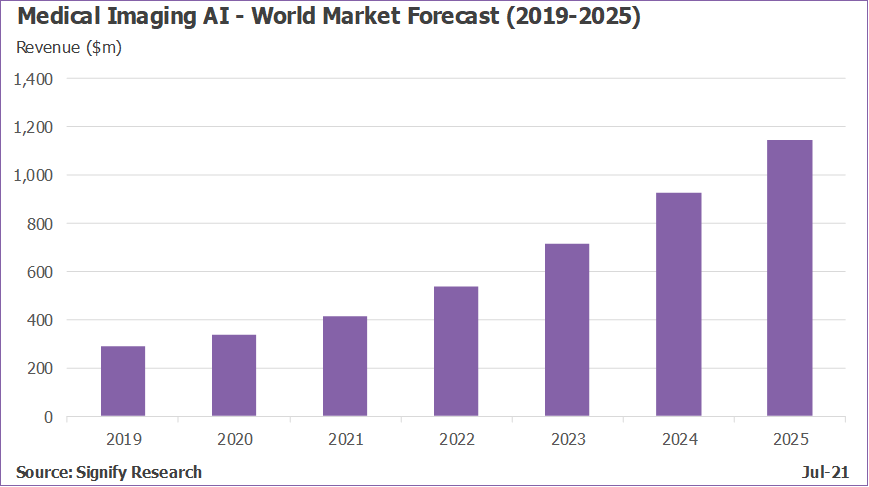

July 2021 – Written by Sanjay M Parekh, PhD, The world market for medical

imaging AI applications is projected to reach almost $1.2 billion by 2025

with a CAGR of 26%, an increase of over $800 million from the market size in

2020.

Despite the COVID-19 pandemic, there have been several positive

developments for the medical imaging AI market in 2020 and 2021 (to date).

These include new product launches (a record number of AI solutions received

US-FDA clearance in 2020), new reimbursement codes (such as the New

Technology Add-on Payment reimbursement for stroke imaging AI in the US), and

the first wave of Class III NMPA approvals in China (permitting the use of

medical imaging AI solutions for diagnostic purposes).

Figure 1: Signify Research’s forecast for the medical imaging AI world

market (2019 – 2025)

However, several barriers are still holding the market back and need to be

addressed. These include the limited number of clinical validation studies

that show the efficacy and efficiency of AI solutions and limited real-world

studies to demonstrate the health economic benefits of AI, to name but a few.

For the market to go on and reach its full potential, customers need to know

the impact of using AI in the real world, have greater confidence in AI

technology, and need to know the value and the return on investment for

AI.

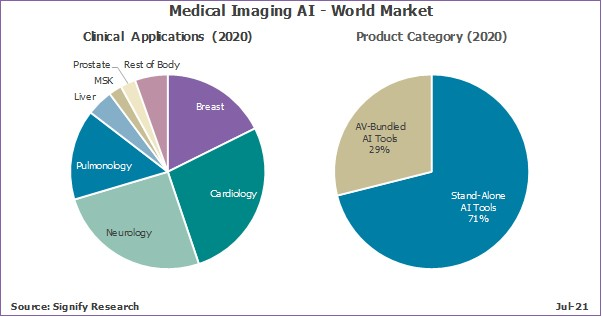

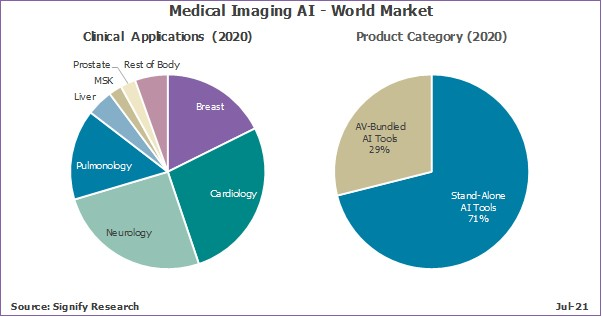

Stand-alone AI software applications account for most of the medical

imaging AI market (Figure 2), but one-third of this market is accounted for

by AI tools bundled on advanced visualisation (AV) platforms. However, the

market for stand-alone AI applications (CAGR 31.9%) is forecast to grow

faster than the market for AV-bundled AI tools (CAGR 3.9%) and will account

for almost 90% of the total medical imaging AI market by the end of the

forecast period (2025).

Most of these software applications and tools are targeted at four clinical

applications (Figure 2), which account for most of the medical imaging AI market

(85%). These clinical applications are (in order of market size): cardiology,

neurology, breast, and pulmonology, and are projected to still dominate the

market in 2025 (82% of total revenue). While the number of new product

introductions of AI solutions for other clinical segments is on the rise,

most notably for prostate and liver imaging, the lack of reimbursement will

initially hold back market uptake of these newer solutions.

Figure 2: The medical imaging AI world market (2020) split by clinical

applications (left) and product categories (right)

Despite some scepticism and suggestions of an AI winter, this remains an

exciting market with medical imaging AI becoming an increasingly important

technology within radiology. Most medical imaging AI vendors remain focused

on automating image analysis and improving workflow efficiencies. However, in

the mid-to-longer term, market growth will depend on vendors delivering value

beyond the primary read, for example, identifying incidentals to avoid missed

diagnoses, using quantitative imaging to reduce the need for biopsy, or

reducing the turn-around time for critical cases such as stroke care.

Vendors may also look beyond radiology, for example by developing companion

diagnostic tools in a bid to partner with pharmaceutical and medical device

companies, or population health tools to aid healthcare providers diagnose

chronic conditions earlier, enabling better treatment and management of these

patients. Ultimately, the solutions that significantly improve patient care

are most likely to be those that receive reimbursement and drive market

growth.

|